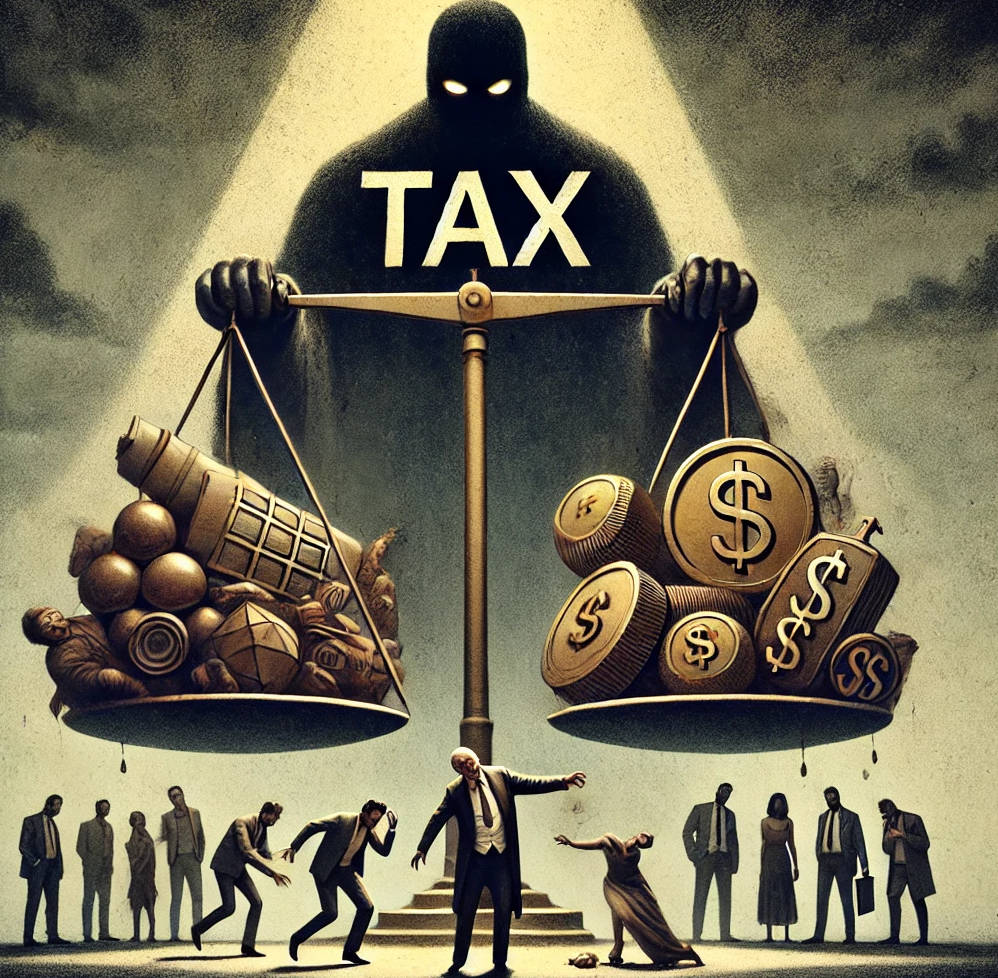

Income tax can hinder social justice by disproportionately impacting certain groups, particularly those striving to improve their circumstances. Taxation on earnings often places an uneven burden on lower-income individuals, reducing their ability to meet basic needs and save for future opportunities. For those just above poverty thresholds, high tax rates diminish disposable income, making upward mobility challenging.

Moreover, income tax can discourage hard work and innovation by penalizing productivity and success. When individuals face heavy tax burdens on higher earnings, they may feel demotivated to pursue advancement, limiting societal progress. Small business owners and entrepreneurs, vital for job creation and economic growth, often experience setbacks due to complex tax structures and high marginal rates, reducing their capacity to expand operations or reinvest profits.

Another concern is how governments allocate collected funds. Inefficiencies, waste, or spending on programs that fail to address inequality can exacerbate existing disparities. When taxation doesn’t directly benefit vulnerable communities, it can deepen mistrust in public systems, leaving marginalized groups feeling neglected.

Additionally, income tax systems often rely on compliance from individuals and businesses, yet loopholes allow wealthier entities to minimize payments through legal strategies. This creates an uneven playing field, perpetuating inequality and undermining perceptions of fairness. Those without access to sophisticated financial advice shoulder a greater share of the tax burden, contradicting principles of equity.

Social justice emphasizes fairness, opportunity, and reducing disparities. Income tax, as currently structured in many places, can counteract these goals by amplifying inequities, discouraging initiative, and undermining trust in governance. Alternatives, such as consumption-based taxation or simplified systems, may better align with justice by promoting fairness while ensuring governments can fund essential services. Addressing the inherent flaws in income tax systems is crucial for advancing social justice and fostering equitable economic conditions.

Leave a Reply